article

A new language to communicate long term value creation

In a recent article called ‘Larry Fink Isn’t Going to Read Your Sustainability Report’ published on HBR.org, author Mark R. Kramer argues that sustainability reporting alone will not help investors understand long term value creation. What is needed is a new language — or at least a new way of bridging social impact and economic performance. The article ends with a call to action: “The need for a new language that bridges sustainability and finance is now.” Funny enough, that language is already there. It is just that not many companies have taken serious steps to try and learn it.

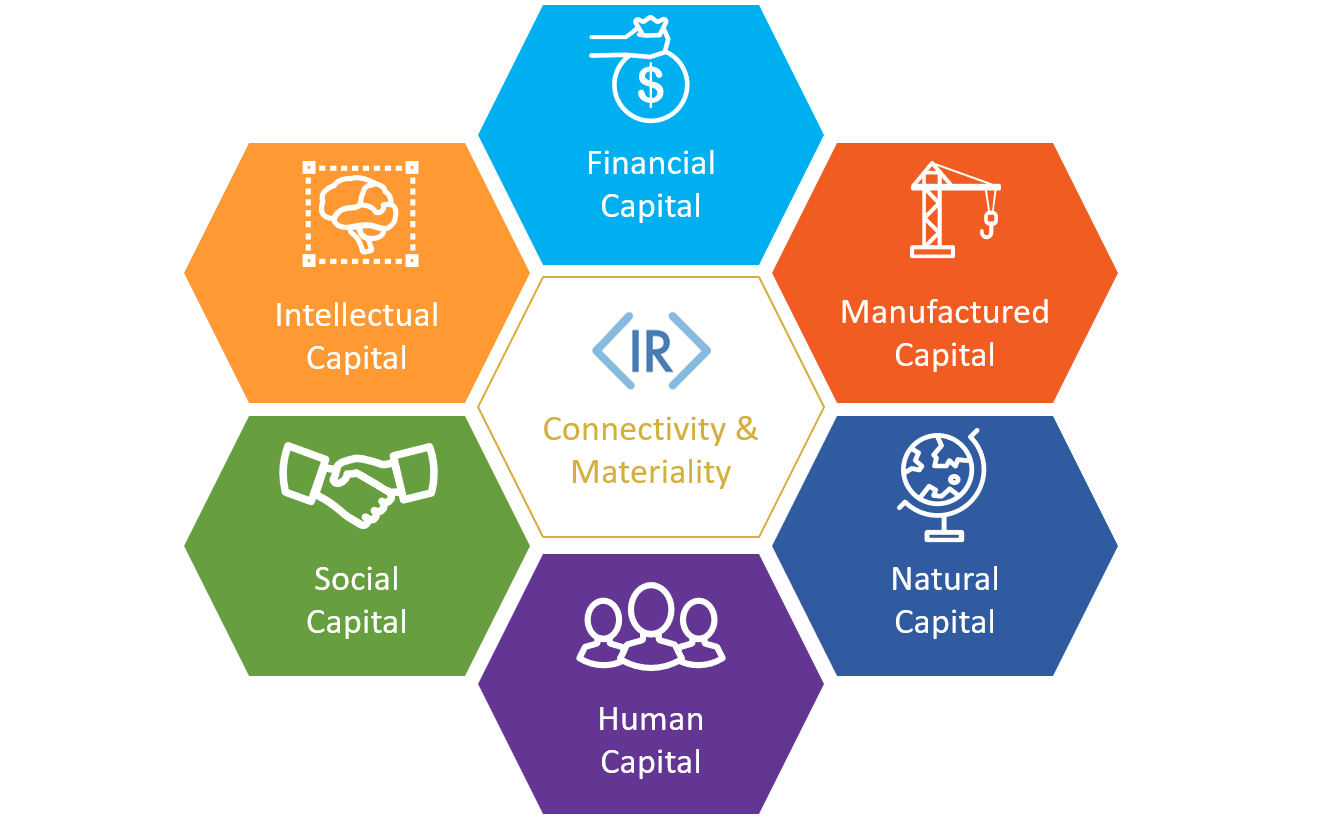

Already as early as 2013, the International Integrated Reporting Council (‘IIRC’) published its Integrated Reporting Framework. Integrated Reporting (

While Integrated Reporting is the language spoken to investors and other stakeholders, the deeper linguistics can be found in Integrated Thinking. Integrated thinking is the active consideration by an organization of the relationships between its various operating and functional units and the capitals that the organization uses or affects. Integrated thinking leads to integrated decision-making actions that consider the creation of value over the short, medium and long term.

Companies shouldn’t try and reinvent the wheel

The challenge that most companies face is how to operationalize integrated thinking. The multi-capital idea and how that translates into actionable plans proves to be stubborn to implement. We firmly believe that companies shouldn’t try and reinvent the wheel. There are many concepts and models readily available to help turn integrated thinking into a reality and to bridge non-financial, intangible value drivers to their financial outcomes. This is what really facilitates a deeper discussion around long term (sustainable) value creation and short term economic performance.

Our own experience in the field of management consulting has provided us with a robust set of tools to operationalize integrated thinking and make

Casper van Leeuwen is executive partner at Satriun, an international Corporate Performance Management consultancy with offices in the Netherlands, Switzerland, France, Germany, Romania, Italy, Israel, Belgium and Morocco. Satriun advises large corporations in the areas of financial consolidation, budgeting & planning, and management reporting.

Posted by

Casper van Leeuwen

Posted on

19.February.2020

Posted in