Starterkit

Cash Flow Forecasting app for scenario modeling in OneStream XF

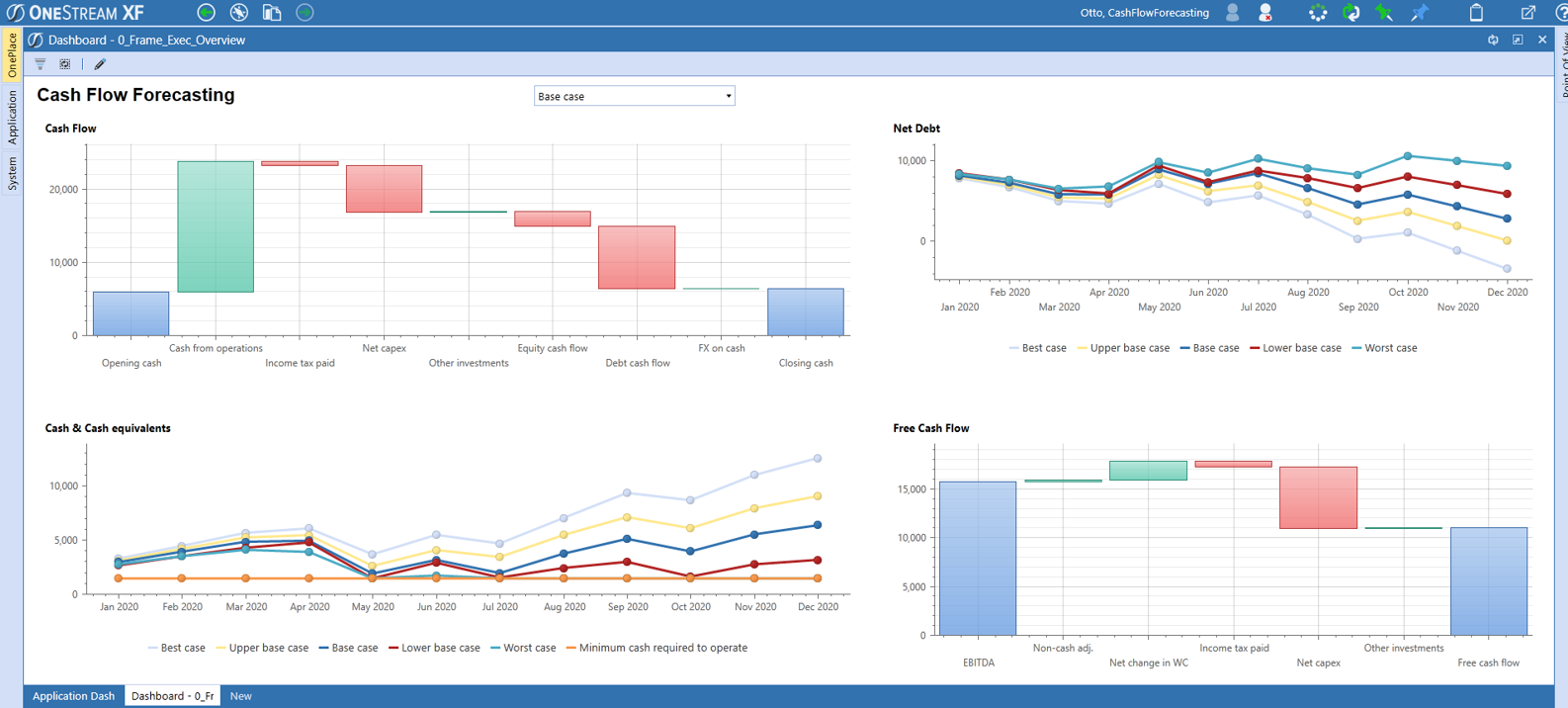

- Ability to forecast income statement, cash flow and balance sheet in a best case, upper base case, base case, lower base case and worst case scenario.

- Income statement scenarios with standardized modeling capabilities around change in productivity levels, change in yield levels, change in purchase price levels, and change in advertising spend.

- Breakdown of operating costs into fixed costs and variable costs in order to support realistic scenario impacts of change in productivity levels.

- Working capital forecasts using intelligent DSO and DPO formulas that include VAT impacts.

- Ability to smartly model the pay out timing of holiday allowance, bonuses, and VAT.

- Ability to smartly model the pay out timing of corporate income taxes.

- Modeling of different levels of capital expenditure.

- Modeling of other investing and financing activities, including mandatory debt repayments.

- Automatic drawing of additional funds in case the cash levels drop below what is considered the minimum cash required to operate, providing valuable insights when additional funds are needed and what those funding needs are.

- Balance sheet forecasts providing relevant insights into monthly working capital levels, total capital employed, net debt levels, and total funds provided.

- Graphs that visualize monthly cash levels for each of the scenario models, monthly net debt levels for each of the scenario models, waterfall analysis of net cash flow for the year, and waterfall analysis of free cash flow for the year.

Want to see a live demo?

Register to attend our Cash Flow forecasting webinar

April 16, 2020 - 4:30 pm till 5:00 pm

Quick to deploy Seed your income statement forecast into the Cash Flow Forecasting app and you’re quickly under way to build your cash flow and balance sheet scenario models.

Intelligent scenario models The Cash Flow Forecasting app features intelligent accounting and financial management rules that provide valuable and realistic insights into the evolution of cash flow and balance sheet under different scenario models.

Business-relevant insights The cash flow and balance sheet models feature relevant insights into topics like working capital, free cash flow, and net debt, speaking a language that is valuable for the financial management of your company.

We make it industry-specific for youThe Cash Flow Forecasting app is industry-independent. Making it industry-specific isn’t a big thing. We make it industry-specific for you as part of the app’s deployment.

Business-owned After deployment your FP&A team is able to own the app and make enhancements if and where needed.